Have 200k Best Strategy to Save for a House

Are you wondering what will happen to the Melbourne property market in 2022?

While Melbourne's housing values accept not grown every bit strongly every bit other capitals, now that Melbourne is out of the longest lockdowns experienced anywhere, the pent-up demand at a time of increasing consumer confidence, an improving economy, and abundant job cosmos ensures connected potent Melbourne business firm price growth in 2022.

However, Melbourne property values:

- fell -0.ane% over the concluding week,

- remained flat this month and so far, only

- increased fourteen.three% over the last yr.

Don't worry… there is still enough of growth left in the Melbourne housing market place, every bit in that location is still potent pent-upwards need from both buyers and sellers.

And with the recent proclamation that international borders are opening upwardly, Melbourne will be a major recipient of new residents putting extra pressure level on our property markets, especially the rental markets.

Certain Melbourne's property price growth slowed down a little lately with more backdrop listed for sale over the concluding couple of months, simply it'southward important to think that buyers are sellers and sellers are buyers – pregnant they will have to live somewhere and many volition be looking to upgrade their accommodation in 2022.

Is it the right fourth dimension to become into the Melbourne property market?

Now I know some potential buyers are asking:

How long can this last? Will the Melbourne property market crash in 2022?

They must be listening to those perma bears who accept been telling anyone who is prepared to listen that the property markets are going to crash, but they have said the aforementioned twelvemonth later on twelvemonth and have been incorrect in the past and will be wrong again this time.

Recently all our major banks have updated their property price forecasts in response to the marketplace'southward resilience in the face up of extended lockdowns.

Westpac sees the Melbourne property market growing 8% in 2022.

Remember the current upturn stage of this Australian property bike only commenced in October 2022 and Melbourne was held back with stops and starts due to the lockdowns.

Normally the upturn stage of the holding bike lasts a number of years and is followed past a shorter nail phase which is eventually cut curt by the RBA raising interest rates or past APRA introducing macro-prudential controls to dampen the exuberance of property investors and home buyers.

However, this time effectually we have experienced an unprecedented charge per unit of growth seeing our property markets perform even more than strongly than anyone ever expected, with the rates of business firm price growth at levels not seen for a number of decades.

While a lot has been said about the twenty% increase in property values many locations accept enjoyed so far this year, it must be remembered that the last height for our property markets was in 2017, and in many locations housing prices remain stagnant over a subsequent couple of years and information technology was really only before this year that new highs were reached.

This means that boilerplate price growth was unexceptional over the long term, averaging out at around four percent per annum over the concluding v years

But recently in that location seems to have been a modify of sentiment about our housing markets from our financial regulators and APRA has forced the banks to increase their interest rate buffers for new borrowers.

So when will this property cycle end?

I see Melbourne'due south property market standing to grow at the rate of 6 to 7% per annum throughout 2022 until eventually, affordability slowed the market down.

Recall the current strong upturn phase of the belongings cycle simply commenced in October 2020.

Normally the upturn stage of the property bike lasts a number of years and is followed by a shorter nail phase which is eventually cut brusque by the RBA raising interest rates or by APRA introducing macroprudential controls to dampen the exuberance of property investors and home buyers.

There is piffling incertitude that APRA's Macro-Prudential controls introduced in November 2022 will have a negative impact on our holding markets – after all, that's what they're intended to practise.

Whether the markets will just feel slower growth or stop dead in their tracks will depend on what measures are introduced in the future.

Withal, as the Melbourne property market is slowing naturally as a result of affordability constraints and greater choice for buyers, hopefully, APRA will remember its lessons from the past and stay out of the market now.

I hope they have learned from the results of previous interventions, otherwise, if history repeats itself, there will exist some unintended consequences.

Watch this space.

Melbourne houses are outperforming

Currently, Melbourne's firm price growth is stronger than unit growth, and while well-nigh sectors of the marketplace have been enjoying strong demand, the more expensive properties are now outperforming Melbourne's less expensive properties.

Looking back the Melbourne property market has been one of the strongest and nigh consistent performers over the last 4 decades.

Over the last xl years:

- The median Melbourne house has increased past 7.9% per annum

- The median Melbourne unit/apartment price has increased by vii.73%per annum

Apparently, this wasn't the aforementioned each and every year, as the Melbourne holding market worked its way through the typical property cycles.

Over the terminal few decades, Melbourne won the mantle of the globe's "most liveable city" more times than any other city in the world.

Needless to say the Covid related lockdowns endured by Melbourne led to some challenging times, but now both buyers and sellers are back, consumer confidence has picked up strongly and belongings transaction numbers have increased and house, auction clearance rates are stiff and prices are rising, however, Melbourne'southward inner-metropolis apartment market place withal looks in bad shape.

Sale clearance rates in Melbourne have remained strong despite the months of lockdowns – showing the resilience of both buyers and sellers and the acceptance of online auctions.

Some of the oestrus gradually came out of the Melbourne auction market at the end of the year as vendors became more than confident placing a tape number of properties on the market for sale past auction in December.

Simply as yous tin can meet from the following chart, Melbourne's auction market started in 2022 strongly.

While in that location is a shortage of quality housing in pop areas across Melbourne, the lower-than-expected population growth has led to an oversupply of housing in some outer suburban new estates.

A prime example of this is Melbourne'due south western suburbs where an additional 18,800 houses are expected to be built over the adjacent 24 months.

Villa units, townhouses, and family suitable apartments will be seen equally affordable alternatives to houses in the highly sought-after inner eastern and s-eastern suburbs of Melbourne.

On the other hand, high-rise apartments in the many Melbourne CBD towers or shut to universities are likely to underperform, remain vacant for a long fourth dimension, and keep decreasing in value.

Houses in regional Victoria with easy access to the capital city are also in strong demand and should continue to increment in value.

Fast facts nigh Melbourne and its property market

Here'south the listing of some vital points you would want to consider:

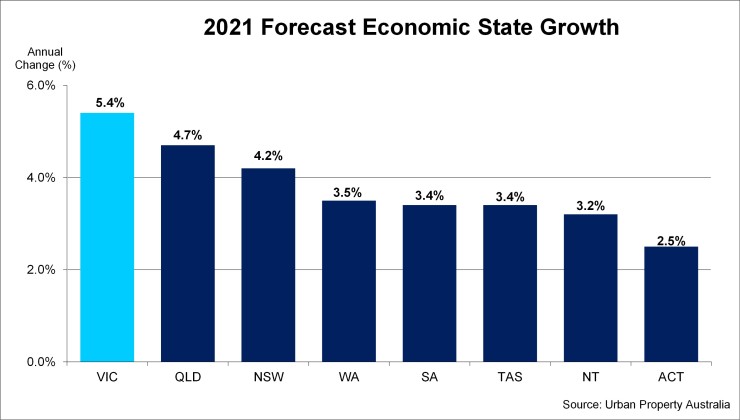

The Victorian economy is holding up well

For years the Victorian economic system has been Commonwealth of australia'due south strongest State economy creating more (and typically higher-paying) jobs than other states and one time we get across the proverbial bridge the government has built for COVID-19, Victoria's economic system will surge again.

The Victorian economy has been hard by the COVID-19 pandemic due to the State'south extended lockdowns last year.

As a result, the Victorian economy contracted by -half-dozen.one% over 2020, compared to -2.8% for the national economy.

But until the most recent (sixth) lockdown, it looked like the Victorian economy was rebounding in 2022 and was likely to outperform the other states this twelvemonth.

Of course, economical growth will now slow down a little until we move out of our Covid cocoon.

Source: Urban Belongings Australia

Merely remember… Melbourne is not i property market…

In that location are multiple markets in this various sprawling city.

Information technology is divided by geography toll points and type of holding into many submarkets – this means you tin can't but buy any holding and count on the full general Melbourne property marketplace to do the heavy lifting for you over the next few years, then careful property selection will be critical.

Then to help you amend empathise what's going on in Australia's second-largest belongings market here is a long matter you should know if you're considering investing in Melbourne property:

Melbourne House Prices

Over the last 4 decades, Melbourne property values have risen at the fastest pace of all capital cities.

Melbourne house prices and market activity were adversely affected by its extended lockdowns during 202 -21, but now Melbourne property is on the movement again.

MELBOURNE DWELLING PRICE TRENDS – Source: Corelogic Feb 2022

Since Melbourne's restriction ease, new listings of properties for sale are surging across the land.

Source: Realestate.com.au Listings Report October 2021

At Metropole we're finding that on-the-ground sentiment has inverse completely with strategic investors and homebuyers already starting to feel a little FOMO (fear of missing out).

However, while house prices have been resilient, Melbourne rental rates are experiencing weaker weather due to a college supply of rental properties, and less demand.

At the same time is more buyers beingness agile in the market, there is currently a shortage of good quality stock on the market.

Melbourne houses are outperforming apartments

Melbourne has seen a record high in the deviation between house and unit of measurement medians at 52.4% equally of June.

Melbourne has also seen the weakest rental market functioning since the onset of COVID-xix, and as a big portion of rental stock are units, this has dampened demand across the segment.

Melbourne has also seen the weakest rental market functioning since the onset of COVID-xix, and as a big portion of rental stock are units, this has dampened demand across the segment.

This also likely explains some of the weakness in the Sydney unit market place, where rental demand was similarly affected by a lack of overseas migration.

Unlike Sydney notwithstanding, Melbourne has seen similar rates of disparity through the 2022 and 2022 calendar years, when the business firm toll premium on units averaged 46.3%.

A prolonged menstruation of high unit supply, and development of high-density stock, kept unit values relatively low through this menstruum.

This dynamic may shift through the residuum of 2021, as ABS information points to a fall in construction of units, and a ascent in the construction of new houses.

Furthermore, affordability constraints beyond the housing segment, which could be amplified by the end of HomeBuilder and temporary stamp duty discounts, may guide more first home buyers dorsum to the unit segment of Melbourne.

Then…is it the correct time to get into Melbourne's belongings market?

Melbourne property prices have been climbing at a breathtaking pace in 2022 with more growth expected every bit potent demand from buyers outpaces the volume of new listings coming onto the market.

This has been good news for homeowners simply heartbreaking for house hunters.

At the aforementioned time, at that place have been mixed messages in the media most what'due south ahead.

Of grade, there's ever the Negative Nellies wanting to tell anyone who is prepared to listen to them the market is well-nigh to crash, but other more solid commentators are suggesting our property market place is slowing downward.

And I agree, I believe the pace of capital gains has peaked, but I'grand not suggesting abode values are about to dip, far from it.

Rather I believe we've moved from a peak rate of growth to a footstep of capital gain that volition exist more sustainable and there's plenty of life left in the Melbourne real estate market with property values likely to keep increasing throughout 2022 and into 2023.

Australia's economy looked similar information technology was going to experience the V shape recovery everybody had been was hoping for, simply at present with prolonged lockdowns in Australia's 2 virtually populous states and therefore our largest economies, economical growth has slowed downwardly.

All the same, as nosotros move out of our Covid cocoons at that place are signs that economic growth will return led by employment growth and this fiscal security volition underpin Melbourne's belongings market moving forwards.

Notwithstanding, some sectors of the Melbourne housing market place will continue to languish this year.

The sectors of the Melbourne real manor market probable to underperform most moving forrard will exist:

- Apartments in high-rise towers – in fact, this is these properties are probable to exist out of favour for quite some time.

- Off-the-plan apartments and poor quality investments stock (as opposed to investment-grade) apartments, particularly those shut to universities.

- Established homes in the outer suburban new housing estates, where young families are likely to have overextended themselves financially and with many people will be out of work for a while. Currently, many beginning home buyers are taking advantage of the various incentive packages including HomeBuilder to buy newly constructed homes, leaving established houses in these locations languishing.

The list of top x Melbourne secondary schools catchment areas

The list for top 10 Melbourne primary school catchment areas

Long term Melbourne property market trends

Source: https://propertyupdate.com.au/property-investment-melbourne/

A property is negatively geared when the costs of owning it – interest on the loan, bank charges, maintenance, repairs, and depreciation – exceed the income it produces.

A property is negatively geared when the costs of owning it – interest on the loan, bank charges, maintenance, repairs, and depreciation – exceed the income it produces.

0 Response to "Have 200k Best Strategy to Save for a House"

Post a Comment